London, 19 October 2023 – CAMPEA (Central Africa Markets Private Equity Association) is pleased to announce that its CEO, Tania Eyanga, spotlighted CAMPEA’s growing regional agenda in the prestigious UK–Francophone West & Central Africa Trade & Investment Forum (WCAF II). Convened by DMA Invest, organised with HM Government, UK Export Finance (UKEF) and the UK Foreign, Commonwealth & Development Office (FCDO). The forum brought together in its second edition senior investors, government delegates, and private sector executives to explore opportunities in the Democratic Republic of Congo (DRC) and beyond.

Amplifying Private Capital in the DRC

In her keynote remarks, Ms. Eyanga emphasized the transformative potential of catalytic private equity in the DRC—highlighting potential financing collaborations for operators focused on leap-frogging innovative technologies sectors, telecoms and data center infrastructure and digital platforms as pivotal growth areas. She also spotlighted the evolving role of private equity in driving ESG resilience in the Democratic Republic of Congo (DRC) with illustrations on increasing availability of domestic funding channels serving to unlock opportunities across backbone of the country’s national domestic industries such as mining and energy, agribusiness, and digital infrastructure. She highlighted how private equity is increasingly serving as a bridge between international investors seeking diversification and local enterprises in need of growth capital and governance support.

“As the biggest market by demography and market size in the region, the DRCongo offer compelling fundamentals waiting to be activated,” said Tania Eyanga, CEO of CAMPEA. With disciplined execution, governance clarity, and capital aligned for long-term growth, private equity can accelerate industry development and meaningful economic transformation. Given recent social, economic and financial performance of financing sponsors, the message is clear: Central Africa—and particularly the DRC—is a frontier that can no longer be overlooked. Private equity has sufficiently demonstrated the ability to accelerate industrialization, formalize value chains, and create scalable businesses that deliver both returns and impact,” she further noted.

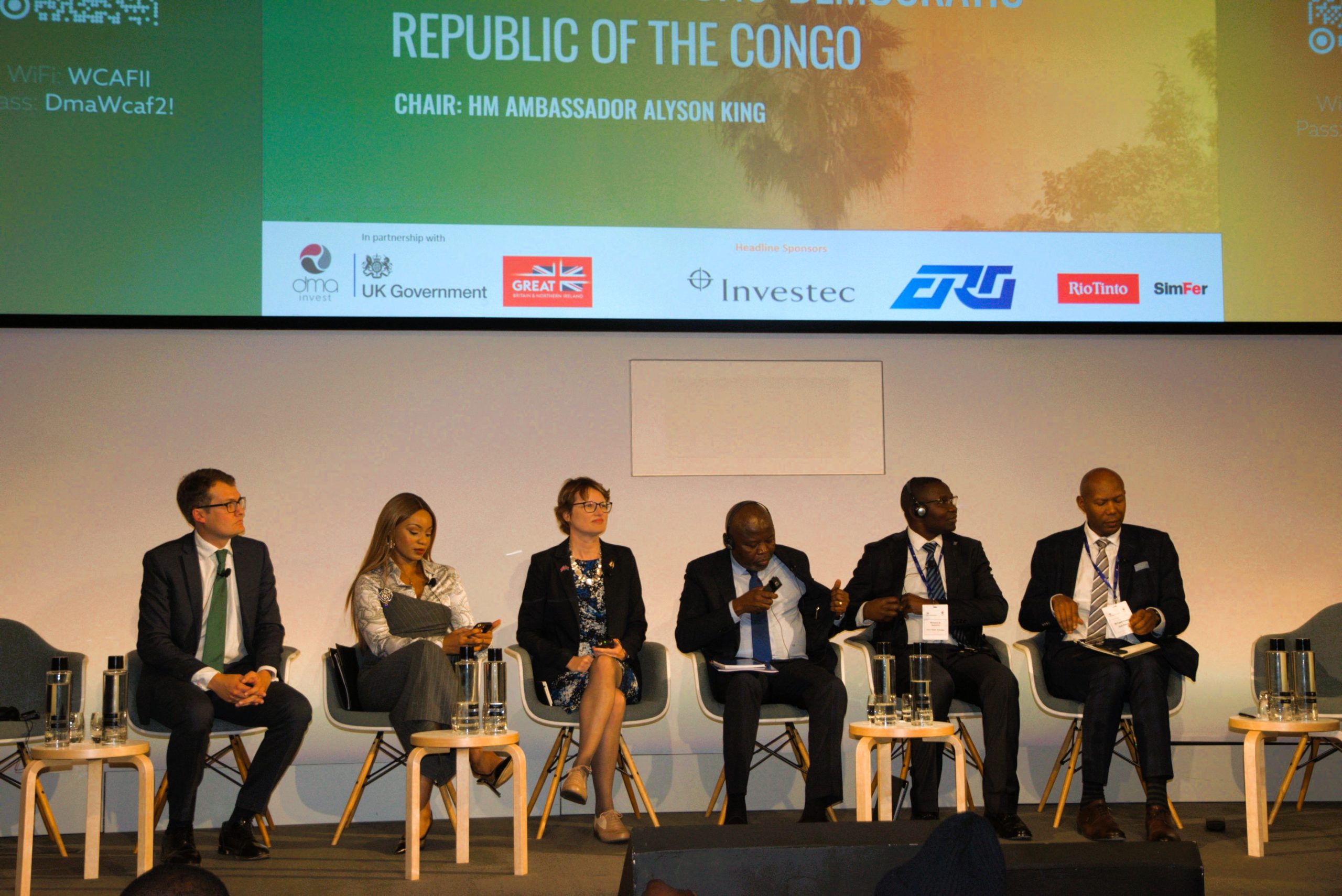

The Forum provided a powerful converging avenue where a diverse stakeholders from varying backgrounds and perspectives discussed the common agenda from their respective purview. This panel, chaired by Ambassador Alison King, Ambassador of the United Kingdom to the DRcongo, was also comprised of UK Export Finance representatives Government officials from DRCongo including Vice-Prime Minister & Minister of National Economy Mr. Vital Kamerhe and Mr. Julien Paluku Minister of Industry complemented by LP operator from British Investment International. to exchange insights on investment opportunities, regulatory shifts, and regional integration. By showcasing the DRC’s evolving investment landscape, CAMPEA reinforced its mission to connect global capital with high-potential markets in Central Africa.

This participation reflects CAMPEA’s continued role in shaping conversations around sustainable capital flows, regional competitiveness, and the institutionalization of private equity as a critical engine for long-term growth.

A High-Impact Forum sponsored by CAMPEA as an official WCAF II Event Partner and co-organiser

For the second consecutive year, CAMPEA proudly stood alongside global partners as an official event partner of the UK–Francophone West & Central Africa Forum. Our continued presence signals not just commitment, but momentum—driving bigger conversations, stronger connections, and sharper visibility for Central Africa’s private equity story on the international stage.

CAMPEA reinforced its role as a trusted convenor for the private investment industry in Central Africa. This continued partnership with the UK–Francophone West & Central Africa Forum underscores CAMPEA’s commitment to amplifying investor dialogue, showcasing the region’s opportunities, and ensuring that the voice of private equity and venture capital remains central to shaping the trade and investment agenda.

The event convened over 800 delegates, including approximately 250 international attendees and 550 UK businesses, underlining its regional and global resonance. The forum featured ministerial panels, specialized vertical sessions, B2G “deal rooms,” and bilateral investor-government engagements. Over £1 billion in investment discussions took place, with tangible UK-backed partnerships initiated during the summit.

CAMPEA’s Strategic Role in the United Kingdom

CAMPEA’s involvement highlighted the association’s commitment to:

-

Positioning Central African economies, particularly the DRC, as high-opportunity but under- capitalized investment destinations.

-

Building trusted multilateral financial diplomacy and investing networks to bridge institutional capital with frontier deals in line with the UK’s strategic ambition to strengthen trade and investment linkages across West and Central Africa

-

Supporting governance standards, transparency, and long-term risk management essential for private equity in evolving markets.

“By showcasing frontier markets through credible industry platforms like WCAF, CAMPEA underscores why Central Africa deserves serious consideration from institutional allocators,” added Ms. Eyanga. This is strategic engagement that unlocks capital, promotes accountability, and positions our region as resilient and investable.”

Looking Ahead

With the UK’s ambition for deeper trade ties in the region, and forums like WCAF growing in scale and relevance, CAMPEA reaffirms its role as the sector’s trusted channel. The association will continue to foster connections, build infrastructure for deal capture, and advocate for a future where private capital translates into lasting economic and social value for Central Africa.