Mandate & Coverage Overview

“Strengthening Strategic Capital Markets Connectivity across the Region, for more Global Positioning. “

The organisation serves as a pivotal bridge linking Central Africa with West, East, and Southern Africa, ensuring stronger regional capital flows. By fostering cross-border investment channels, CAMPEA positions Central Africa at the heart of Africa’s integrated private capital ecosystem, enabling investors, enterprises, and policymakers to connect seamlessly across markets.

CAMPEA’s mandate is anchored in advancing private equity and alternative investments in the collective financial markets, positioning the region as a credible and competitive destination for private capital. With its unique geographic and economic composition, Central Africa represents both a frontier opportunity and a strategic hub linking West, East, and Southern Africa.

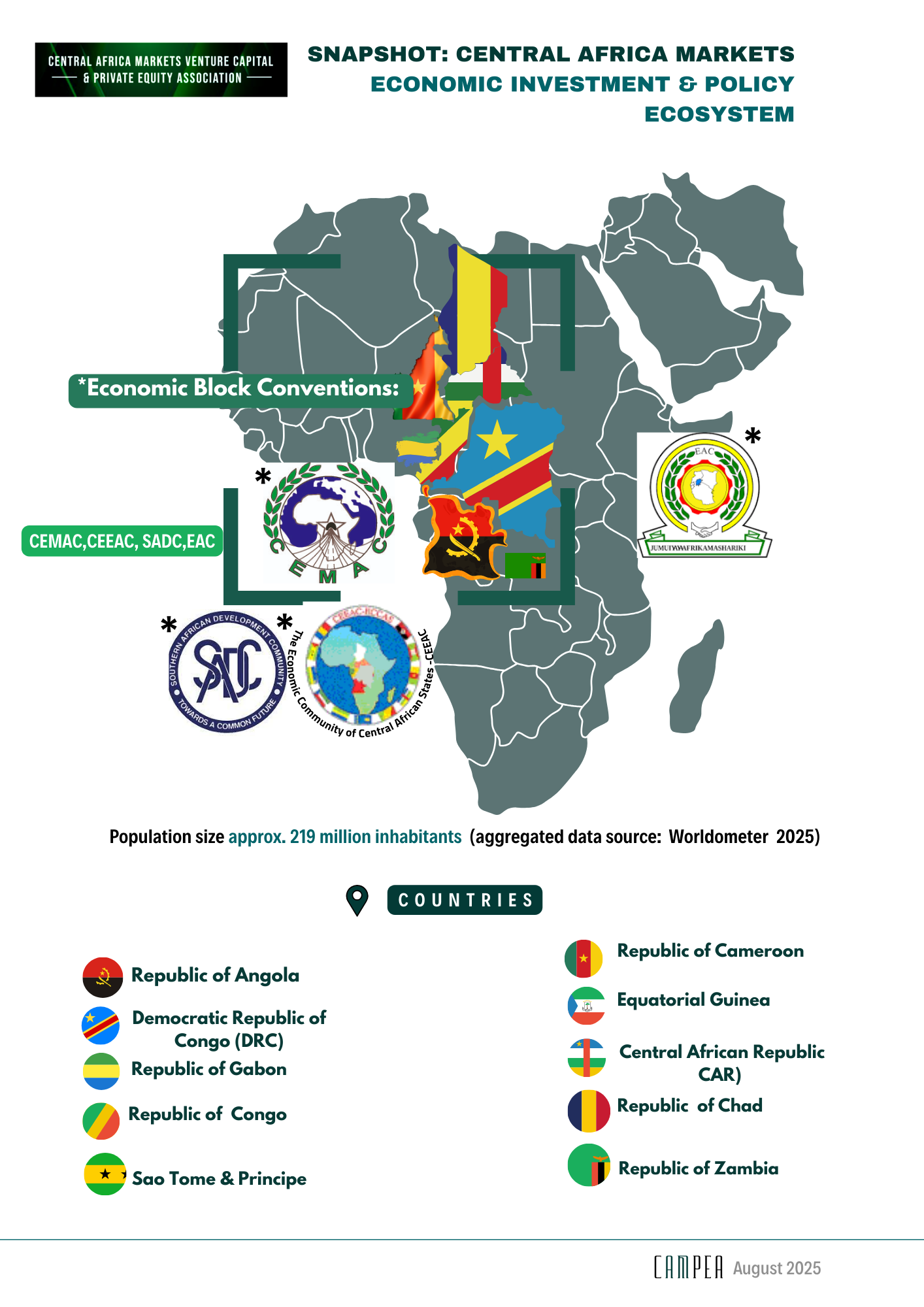

Our coverage extends across the CEMAC and ECCAS member states, including:

-

Cameroon, Central African Republic, Republic of Congo, Chad, Republic of Congo, Equatorial Guinea, and Gabon (CEMAC)

-

Democratic Republic of Congo, Angola, Zambia, São Tomé & Príncipe (ECCAS, EAC, SADC aligned states)

Significance & Legacy

This scope ensures representation of both established economies such as Cameroon, Gabon, and Angola, as well as emerging markets like Chad, CAR, and São Tomé. CAMPEA actively facilitates cross-border investment flows, fosters regional integration under the AfCFTA framework, and aligns with broader continental priorities in capital markets development.

Through the articulation of a defined conciliated agenda by corporate and institutional financing entities, along with companies, project developers, real estate vehicles and conglomerates, aligned in proximity with portfolio managers sovereign wealth funds, and regulators, CAMPEA creates a conveyor platform where regional depth meets global connectivity. This allows members to access a consolidated investment ecosystem, build portfolio diversification strategies, and unlock sustainable growth opportunities across Central Africa.

Driving Impact for Our Members and the Financial Ecosystem

Actionable Investment Intelligence

Gain exclusive research, transaction data, and insights to make informed investment decisions across Central Africa. CAMPEA provides members with timely, actionable insights and comprehensive data on private equity and venture capital trends across Central Africa. This enables investors, fund managers, and corporates to identify opportunities, anticipate market shifts, and make informed strategic decisions that drive growth and sustainable value creation.

Shaping Regional Investment Policy

CAMPEA provides the platform for stakeholders at the forefront of industry knowledge and policy guidance that shape investment strategies, influence market standards, and drive informed decision-making. We actively engages with governments, regulators, development partners, and key industry stakeholders to shape policies that foster a conducive investment environment. Members gain access to insights on regulatory developments, participate in consultations, and have a voice in initiatives that enhance market transparency, streamline capital flows, and strengthen the overall investment ecosystem in Central Africa.

Emerging Investor & Executive Development

CAMPEA offers tailored programs, workshops, and masterclasses designed to enhance governance, operational efficiency, and investment acumen. Members benefit from targeted learning that equips fund managers, corporate finance teams, and executives with the skills and knowledge needed to optimize capital deployment and drive sustainable growth across Central Africa through capability enhancement, leadership & competency Development, market skills advancement.

Regional Capital Market Spotlight

CAMPEA amplifies members’ presence and leadership across the entire investment ecosystem. Through participation in our industry events, awards, research initiatives, and networking initiatives, members gain industry-wide visibility, strengthen credibility, and unlock opportunities for collaboration, co-investment, and strategic partnerships throughout Central Africa. Fund managers enhance exposure and gain recognition for their performance and expertise, strengthening their market credibility, attracting LPs diversification and allocation opportunities.

Investment Promotion Agencies

CAMPEA actively collaborates with national and regional investment promotion agencies (IPAs) to identify and showcase investable opportunities across Central Africa. By facilitating dialogue between fund managers, corporates, and IPAs, CAMPEA helps streamline investment pipelines, attract international capital, and promote projects with high developmental and financial potential. This partnership approach ensures that members gain early access to vetted opportunities while supporting the region’s broader economic growth agenda.

Government, Regulators & SWFs Synergies

Under its umbrella, CAMPEA actively promotes direct engagement between with Sovereign Wealth Funds, creating structured platforms for dialogue, integrated opportunities, and strategic partnerships. By hosting roundtables, private briefings, and investment forums, CAMPEA ensures that fund managers can showcase investable pipelines, align with long-term capital objectives, and access institutional support, while SWFs gain curated visibility into high-potential Central African projects. This approach strengthens market confidence, accelerates capital deployment, and drives sustainable economic growth across the region.

Vision in Action: Market Integration

The Central Africa Markets Private Equity & Venture Capital Association (CAMPEA) is the sole regional industry body dedicated to advancing private capital investment across Central Africa. Established to foster a dynamic investment ecosystem, CAMPEA serves as a trusted platform for fund managers, investors, corporates, policymakers, and development partners.

Through its four core pillars — market intelligence, capacity building, advocacy, and networking — CAMPEA drives greater access to capital, strengthens governance, and enhances the visibility of investment opportunities across the region. The Association provides thought leadership, facilitates knowledge exchange, and champions best practices to ensure that private equity and venture capital serve as catalysts for sustainable economic growth.

With a strong network of members ranging from institutional investors and general partners to development finance institutions and corporates, CAMPEA is uniquely positioned to bridge regional and global investment communities. By convening key stakeholders, publishing industry data, and promoting the region on the international stage, CAMPEA is building the foundation for a resilient, innovative, and competitive Central African private capital market.

We know our clients’ brands inside and out to create bespoke campaigns that bring the brand story to life, engage with consumers and inspire the media.

- Capital Mobilization – Channels regional and international private capital into Central African enterprises and infrastructure.

- Job Creation – Stimulates employment through investment into high-growth companies and SMEs.

- Industrial Growth – Supports sectoral diversification in industries such as energy, agribusiness, fintech, and healthcare.

-

FDI Attraction – Serves as a trusted knowledge center for international investors to enter Central African markets with reduced barriers.

-

Policy Modernization –A thinktank that encourages reforms that improve the investment climate, ease of allocation and investing, as well as regulatory clarity.

-

Market Expansion – Facilitates cross-border investments, enhancing Central Africa’s integration with continental and global markets.

-

Improved Competitiveness – Strengthens corporate governance, financial discipline, and operational standards of local businesses.

-

Wealth Creation – Generates returns for fund managers, investors, and sovereign wealth funds, while broadening domestic capital markets.

-

Infrastructure Financing – Mobilizes private equity and venture capital into transformative infrastructure projects.

-

Innovation & Technology Transfer – Promotes entrepreneurship, digital transformation, and regional adoption of global best practices.