CAMPEA Chair to Join Sovereign Wealth Funds Expert Panel at Mining Indaba 2025

CAMPEA Chair to Join Sovereign Wealth Funds Panel at MI25

London, 24 November 2024| Scheduled for 6 February 2025,The Investing in African Mining Indaba 2025 will feature a compelling panel on the role of Sovereign Wealth Funds in African Mining Investment, showcasing the growing influence of state-backed investment vehicles. This seeks underscore the importance of sovereign funding in de-risking and scaling mining projects across the continent—especially critical in Central Africa.

In line with this agenda, CAMPEA is pleased to confirm that its Chair, Tania Eyanga, will appear on a high-profile panel titled “Planting the seed: how SWFs can positively impact both domestic and capital markets” at the upcoming Investing in African Mining Indaba 2025.

The 2025 mining gathering edition will bring together key institutional players, including sovereign fund representatives, government ministers, and industry leaders, to explore how state-backed capital is evolving to support strategic mining investments across Africa. Notably, sovereign wealth funds—such as the Fundo Soberano de Angola (US $3.9 billion AUM) and Botswana’s Pula Fund (US $3.5 billion AUM)—play increasingly pivotal roles in supporting regional value chains and enhancing developmental outcomes.

“ Sovereign wealth capital brings not only scale, but strategic partnership to Central Africa’s mining economies. Given favourable commodity market conditions and revenues driven by a surge of demand of African industrial critical mineral exports, African SWFs in particular stand at he intersection of favourable capital positions in their balance sheets generated from growing mining production proceeds and beyond. It has become of paramount importance to examine the expected role of various financing models applied by sovereign wealth funds (SWFs), and assess how they are leading and shaping investment of Africa’s mining sector, said Tania Eyanga, Chair of CAMPEA.

Engaging with this domestically sourced funding is a critical factor to catalyzing investment in African battery mining– it brings much needed financial support to public and private scalable infrastructure operators de-risking supply chain impediments whilst supporting technology innovation and local mineral transformation via the promotion of domestic outsourcing models. This in turn certainly ensures that capital allocation is both aligned with national economic and developmental targets which the SWFs are servicing. I look forward to joining esteemed fellow panellists at Mining Indaba 2025.”

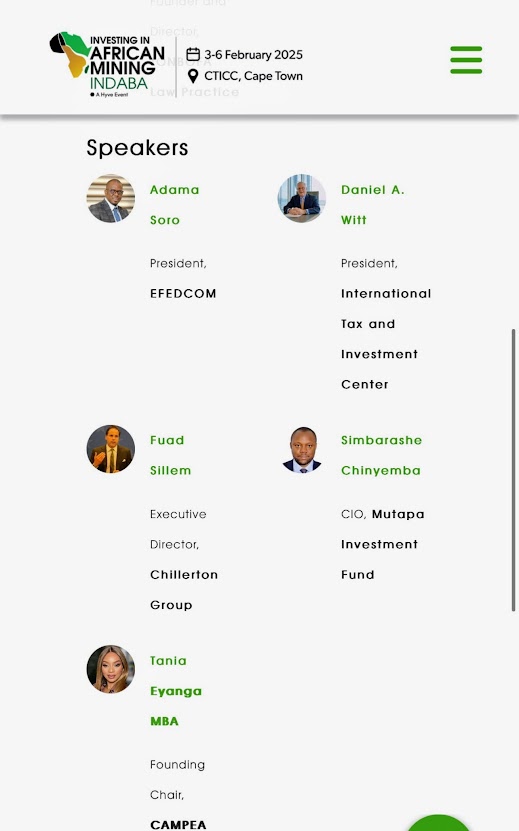

This session convenes a distinguished line-up of financial and investment industry leaders, government representatives, and sovereign fund executives to examine the increasing influence of sovereign wealth capital in financing African mining initiatives. Confirmed panel participants include:

-

Adama Soro, the President of EFEDCOM, the ECOWAS Federation of Chambers of Mines

-

Daniel A. Witt, President, International Tax and Investment Center

-

Simbashe Chinyemba, Chief Investment Officer, Mutapa Investment Fund

-

Fuad Sillem, Executive Director, Chillerton Group

CAMPEA’s participation at Mining Indaba 2025 underscores its pivotal role as the voice of private capital in Central Africa, to unlock frontier-market potential across the continent. By bringing regional perspectives to global forums, the organisation’s aim is to bridge the gap between institutional investors, sovereign wealth funds, and local mining operators, showcasing the investment potential of frontier markets while advocating for best-in-class governance, transparency, and sustainable development. Its presence not only elevates Central Africa on the international mining stage but also reinforces the association’s mission to mobilize private capital effectively, unlock new opportunities for junior and mid-cap mining companies, and drive transformative economic impact across the region.