CAMPEA Joins Industry Leaders to Advance Sustainable Investing in Africa at AVCA Sustainability Conference 2023

- October 12, 2023

- Posted by: admin

- Category: Uncategorized

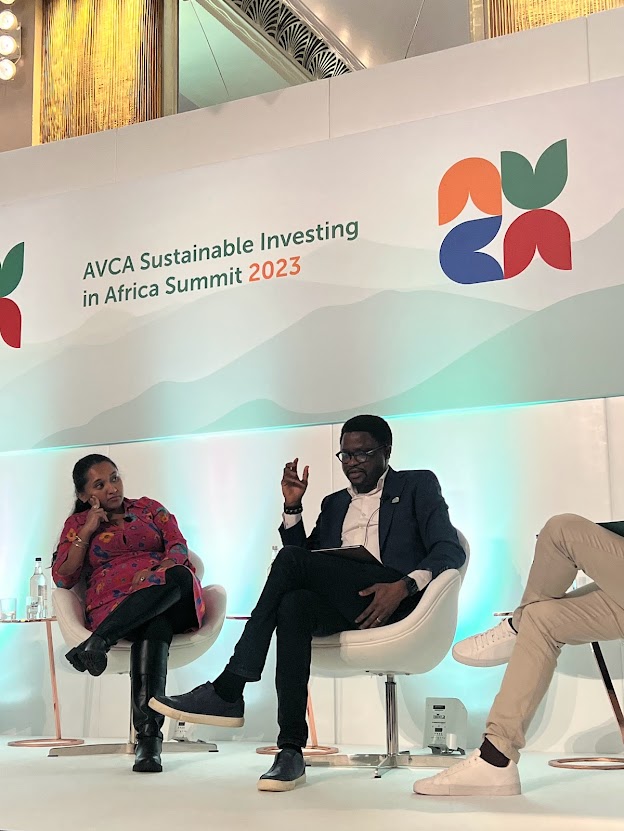

London | October 12, 2023 – The Central Africa Markets Venture Capital & Private Equity Association (CAMPEA) proudly participated as a regional industry association partner at the AVCA Sustainability Conference 2023, a premier convening of global investment management leaders committed to advancing sustainable investment practices across Africa. Through its official partnership with the AVCA. Africa Private Capital Association, CAMPEA reaffirmed its commitment to shaping responsible investment principles and frameworks while our CEO engaged active portfolio operatives and institutional stakeholders with high-potential for regional allocation in Central Africa.

The conference assembled senior decision-makers from institutional investors, fund managers, development finance institutions (DFIs), and policy stakeholders, providing a platform to exchange insights on ESG integration, blended finance structures, and impact measurement. For CAMPEA, this partnership represents a strategic opportunity to position Central African private markets as robust, transparent, and impact-driven destinations for global capital.

CAMPEA’s Leadership and Insights

Private capital in Africa is entering a new phase of maturity. In 2024, capital raised for Africa-focused funds surpassed US $4 billion, more than doubling year-on-year—an encouraging signal of sustained confidence despite a challenging global macroeconomic environment.

On the other hand, private equity deal flow in Central Africa remains modest. Although Central Africa currently accounts for only around 1% of the continent’s private equity transactions with slight variations year on year, the region is positioning itself as one of the most dynamic frontiers. With innovation, demographic growth, and untapped resource potential, we are seeing increasing attention from long-term allocators seeking differentiated opportunities.

At the conference, Founder Tania Eyanga engaged stakeholders redefining how private equity in Central Africa is increasingly leveraging catalytic capital to achieve both financial returns and measurable social impact. Her presence emphasized that ESG is not an ancillary agenda, but a core driver of value creation especially in frontier markets:

“Sustainability is central to how we define successful investing in any industry, sector or geographical market. Alternative capital from debt to equity, when deployed responsibly, accelerates industrialization, strengthens private sector endurance, creates enhanced technical assistance for enhanced companies’ governance, and generates long-term economic and social outcomes—while delivering compelling returns to investors,” said Tania Eyanga, Chief Executive Officer – CAMPEA. Our collaboration with AVCA and continued engagement with global forums are a testament CAMPEA’s commitment to constructing the bridges — not just discussions — that channel capital into Central Africa. Every partnership advances our mission to embed private equity as a strategic and impactful asset class in the region’s development journey. At CAMPEA, our mandate is to build the credibility, scale, and institutional frameworks that can unlock this opportunity. With over US $10 billion in Africa-focused dry powder awaiting deployment at the end of 2024, the priority now is to channel this capital effectively into scalable ventures in Central Africa. That is both the challenge and the opportunity we are determined to deliver on.”

Enriching panels, direct discussions and roundtables further provided vital insights: by bringing to the fore the ESG applicability and challenges encountered and identifying common threads relative to investors’ experience in facing market conditions while maintaining or increasing their standards.

Through its CEO’s stakeholders’ engagement, CAMPEA contributed to the following industry key points:

-

Best Practices in ESG Integration: How private equity managers can embed environmental, social, and governance considerations into deal sourcing, due diligence, and portfolio management.

-

Catalytic and Blended Capital: Leveraging DFIs and structured finance to de-risk frontier investments while increasing capital deployment in priority high-impact sectors that satisfy Central Africa dynamics

-

Measuring Impact and Performance: Frameworks for assessing both financial returns and social/environmental outcomes in frontier and emerging markets.

-

Regional Investment Opportunities: Providing global investors with actionable intelligence on Central African markets, from growth sectors to regulatory developments and emerging fund structures.

Strategic Significance for Asset Managers

The 2023 AVCA Sustainability Conference reflects a growing recognition among LPs, GPs, and institutional allocators that ESG-aligned investment is not only responsible but strategically differentiating, particularly in frontier markets like Central Africa. CAMPEA’s role as a regional partner reinforces its mission to:

-

Advocate for best-in-class governance, transparency, and operational excellence in Central African funds;

-

Curate high-quality deal flow for international investors seeking exposure to frontier opportunities;

-

Foster cross-border collaboration between LPs, GPs, and policymakers to strengthen the region’s investment ecosystem.

Through its partnership with AVCA, CAMPEA continues to amplify Central Africa’s visibility in the global investment community, providing capital market intermediaries or institutional investors with both the confidence and the intelligence needed to deploy capital responsibly and strategically.